Maersk and Hapag-Lloyd have recently announced the Gemini Cooperation. This new Vessel Sharing Agreement (VSA) will have a significant impact on the shipping industry. This article examines this development in detail.

1. Gemini: The start of a new chapter in shipping alliances

The shipping landscape is set for a significant shift with the announcement of the Gemini Cooperation between Maersk and Hapag-Lloyd. This partnership, which will start in February 2025, follows the announcement in January 2023 of the termination of the 2M Alliance VSA agreement between Maersk and MSC.

The 2M Alliance was a “near unstoppable force,” according to Johan Sigsgaards, Maersk’s Chief Product Officer, Ocean. When the 2M Alliance dissolved, Maersk clearly stated that its business model was incompatible with an alliance, only to subsequently announce a new partnership with a different entity within a year. One could guess that Maersk encountered a disadvantage due to its relatively smaller fleet. To regain its competitive edge, Maersk sought out a new partner, Hapag Lloyd.

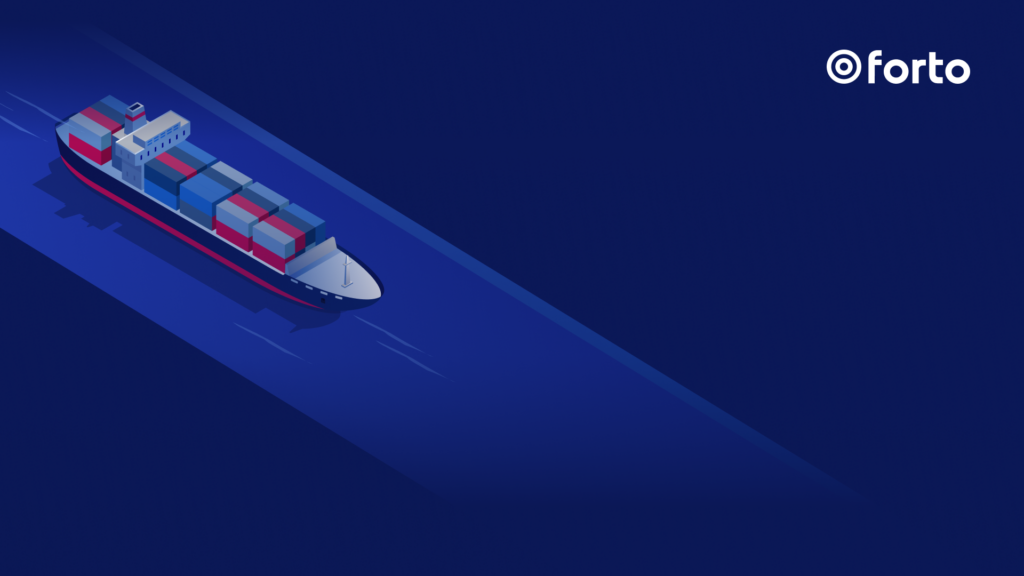

Carriers in perspective: MSC, Maersk and Hapag Lloyd total capacities and market share side by side

To enter into the recently announced Gemini cooperation. This venture, symbolically named after the twins of Greek mythology, reflects a belief in shared business DNA with shared culture and goals. The partnership will operate with a fleet of approximately 290 vessels, boasting a capacity of 3.4 million TEUs and a formidable presence in the industry. The cooperation will be slightly smaller than the total capacity previously provided by Maersk and MSC on the routes planned for 2025, which is 3.6 million TEU with 372 ships. Gemini will cover seven global (sub)trades, providing 26 mainline services focused on 12 key hub ports. This includes 10 owned or controlled terminals and two operations in Singapore and Cartagena. Maersk will contribute 60%, while Hapag-Lloyd will contribute 40%.

Gemini represents a more closely aligned operational approach, reflecting shared philosophies. Personally, I confess, the 2M (MSC and Maersk) was more surprising to me than the newly announced Gemini Cooperation. However, fraternal twins can still have notable differences. Size, though important, is just one factor to consider among many.

2. Pursuing 90% reliability as a differentiation strategy

Gemini’s ambition for 90% reliability is a commendable goal, promising to enhance the resilience of the global supply chain. The hub and spoke model is not really new but could have the potential to revolutionize ocean freight services, although its success in this new domain remains to be proven.

Effective control of terminals and dedicated shuttle vessels will be crucial. Past challenges with transshipments, both physical and digital, highlight the need for thorough planning and execution. The combined terminal assets, fleet size, and configuration of Gemini appear promising, yet the integration of numerous spoke terminals will be a critical factor to watch.

This model raises some interesting questions: would one of the partners cancel existing contracts in favor of the other (e.g. Rotterdam)? But then, how do they serve other trades outside of Gemini cooperation (e.g. Latam)? How will they move cargo throughout the terminals? Time will tell. But it will be interesting to learn more about this since this is one of the critical elements for the desired hub and spoke model.

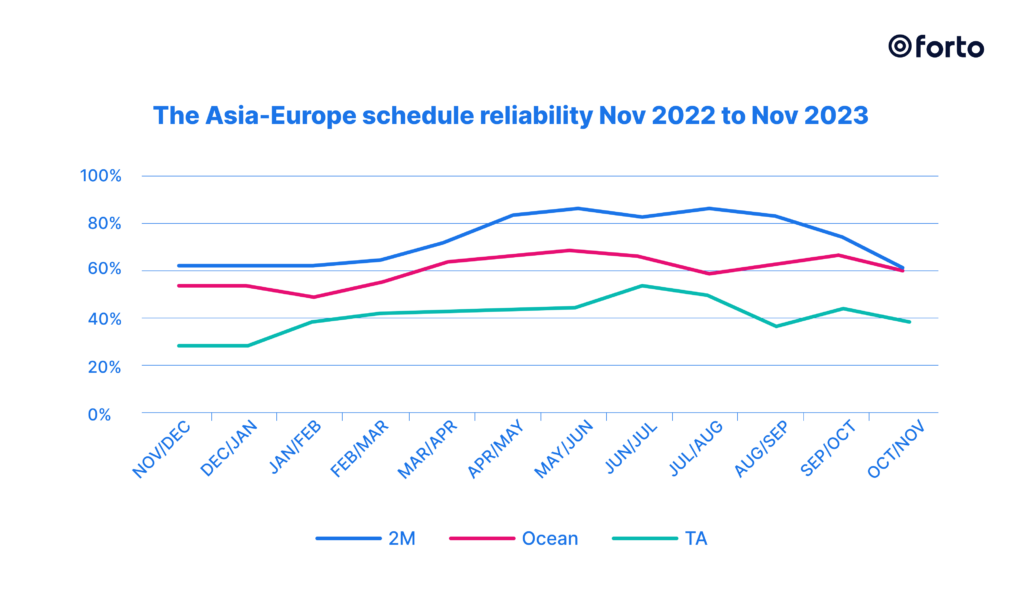

Before the Red Sea shipping crisis, carrier reliability was trending downward, and it is interesting to note that 2M had the highest level of reliability, although their 60% score at the end of 2023 indicates there’s still margin for improvement. Alliances with multiple members are facing challenges in maintaining their reliability levels and showing significantly lower scores.

The declining service scores in late 2023 can be attributed to multiple factors. However, it seems evident that having more partners at the table makes it challenging to maintain consistently reliable services, as each partner tends to prioritize their own strengths and interests.

Analyzing past liner performance, it’s clear that carriers can significantly differentiate themselves through reliability. If Gemini achieves its ambitious target, it will establish a new benchmark for the industry.

3. Strategic implications and alliance dynamics

The departure of Hapag-Lloyd from THEA will inevitably lead to a reshaping of the wider carrier alliance landscape. This latest development places ONE, Yangming, and HMM with a diminished market share, reduced service scope and limited market coverage. The bleak prospects for THEA carriers are evident in the market share collapsing without Hapag-Lloyd. On the Transatlantic route, THEA will only have a 3 percent share. The trade route between Europe and the Indian subcontinent looks even bleaker with only a 2 percent market share.

THEA’s hope lies in the trades traditionally dominated by Asian carriers between the Middle East, the Indian subcontinent, the Far East, and North America. In this market, THEA will be a leader with a 36 percent share, surpassing Gemini with 29 percent. However, THEA cannot match the extensive networks of the Ocean Alliance, MSC, and the newly formed Gemini. To remain competitive, THEA must make a critical decision: find a new partner, innovate, or face defeat.

But it’s not just about Hapag-Lloyd and their ex-partners. The announcement of the Gemini cooperation will also put the Ocean Alliance – CMA-CGM, COSCO, and Evergreen in the spotlight. These days, carriers are likely re-evaluating their positions, carefully analyzing their current alliance setup and gauging opportunities for new alliances or strategies.

4. Gemini is only the next chapter; expect more.

The Gemini Cooperation marks a new chapter in maritime alliances, poised to reshape the competitive dynamics of the shipping industry. As we move towards its implementation in 2025, the focus will be on monitoring its impact on global trade routes, operational efficiency and overall industry standards. At Forto, we remain vigilant and agile, ready to navigate these changes and continue providing unparalleled service to our clients.