Houthi militias in the Red Sea have launched over 25 drone and missile attacks on ships, leading to a 90% decline in container activity within the Suez Canal. On January 12th, America and the United Kingdom responded with precision strikes on 60 targets across 16 locations identified as bases of operation for the Iranian-backed Houthi militants. These targets included a range of strategic points such as command and control nodes, munitions depots, launching systems, production facilities, and air defense radar systems.

This decisive action followed the interception of an oil tanker by Iranian forces near the Oman coast and the launch of an anti-ship missile by Houthi forces from Yemen into the critical shipping lanes of the Gulf of Aden. Remarkably, this incident marks the 27th such attack by the Houthis on international shipping over the last two months.

In response, U.S. President Joe Biden has articulated that these strikes were a direct countermeasure to the escalating Houthi aggression impacting international maritime vessels in the Red Sea, a critical maritime corridor. This area is pivotal for global commerce, with approximately 15% of worldwide maritime trade transiting through it. This includes significant percentages of the global grain, seaborne oil, and liquefied natural gas trade.

From a logistics and shipping industry perspective, there are several key takeaways:

- Decisive Action by International Forces: The international coalition is actively working to secure and safeguard global trade routes. This move underscores the commitment of global powers to protect the essential arteries of international commerce.

- Potential Acceleration Towards Conflict Resolution: The military strikes aim to neutralize the disruptive activities of the Houthis. A successful campaign could expedite a resolution, leading to the restoration of normal maritime traffic through the Suez Canal. As a consequence, the industry may observe adjustments in freight rates in the short term.

- Interim Operational Challenges: The current uncertainty, likely to persist for weeks to months, suggests that the remaining vessels traversing the Suez Canal may adopt a cautious stance. This ‘wait and see’ approach could exacerbate existing delays, further straining capacity and equipment availability, particularly in the run-up to the Lunar New Year in February.

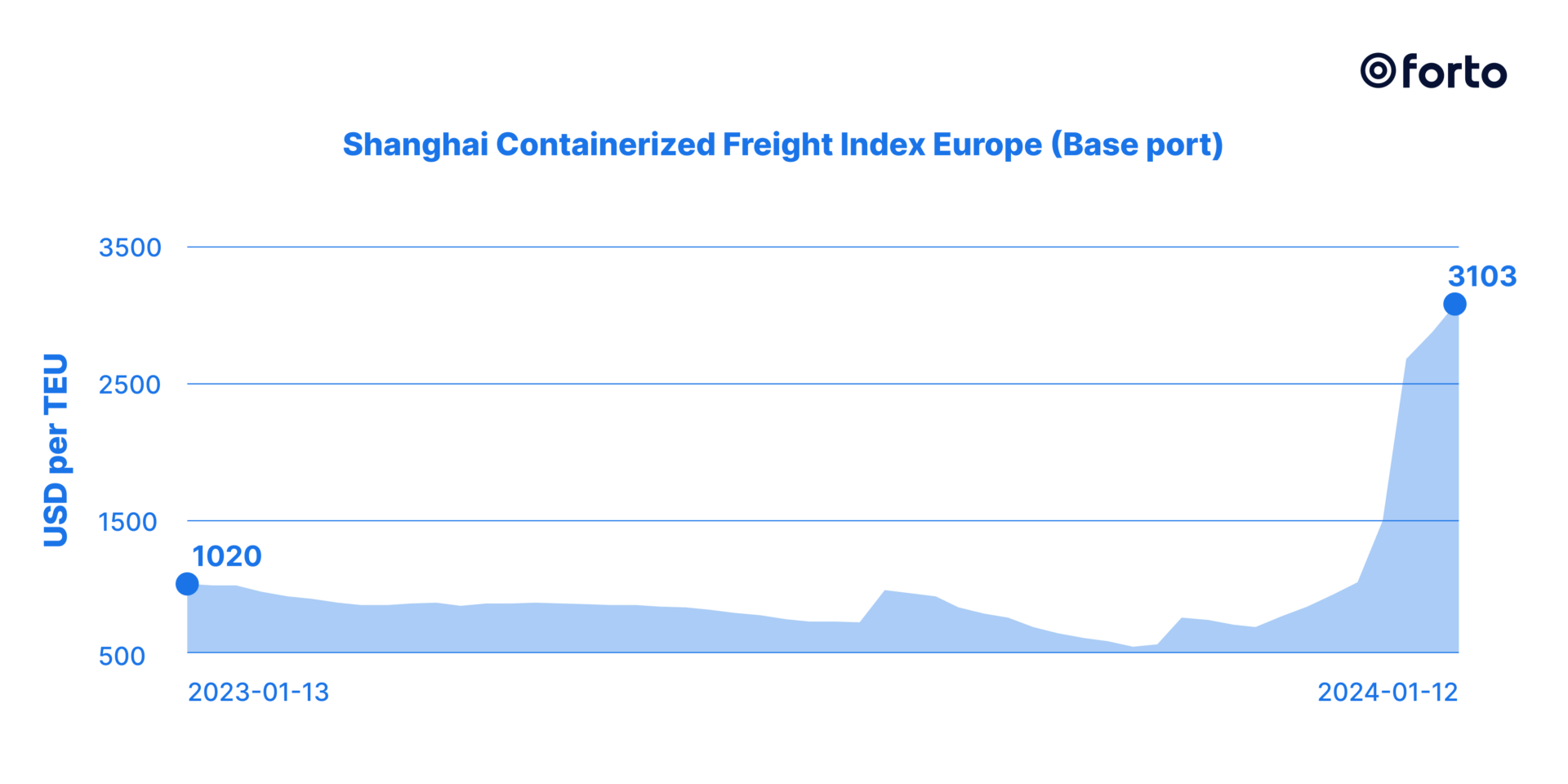

Prior to these military actions, the shipping industry had already experienced a notable surge in rates. There has been a 201% increase in the Asia-Europe route rates since December 15, as reported by the Shanghai Containerized Freight Index (SCFI). Rates are expected to peak in week 5, with challenges continuing in the Mediterranean trade after the New Year celebrations.

In conclusion, while the situation remains fluid, the shipping and logistics sector must remain agile, monitoring developments closely. The industry is well-versed in adapting to geopolitical changes, and this scenario is no exception. As we continue to navigate these challenging waters, expertise and resilience will be key to maintaining the flow of global trade.