The global logistics industry faces its latest challenge in the ongoing Red Sea shipping crisis. As more shippers seek alternative transport modes to avoid maritime bottlenecks, we expect a rise in demand for rail freight services. After two years of prolonged conflict in Ukraine, which has significantly changed geopolitical and economic dynamics, the rail freight market now requires careful examination due to its unique position.

As Forto’s leading rail freight expert, I want to share our insights into the evolving rail freight landscape, particularly considering the backdrop of the Ukrainian conflict and how lessons from the recent COVID pandemic can help mitigate and adjust to this next crisis in the Red Sea.

Rail Freight Developments During the COVID-19 Pandemic:

Prior to the COVID-19 pandemic, we saw a stable European economy with robust trade between Europe and China. The demand for consumer goods, spare parts, and medical equipment surged, significantly boosting rail freight connections between the EU and China with great speed and reliability.

The COVID-19 pandemic had a profound impact on rail transport in the EU. The impact on rail freight varied across Europe. While Ireland and Bulgaria saw increases of 30% and 19%, respectively, Latvia, Estonia, and Germany experienced significant declines. Germany, in particular, saw a drop of 20 million tonnes in rail freight transport in 2020 compared to 2019.

Changes Post-COVID and the Ukrainian Conflict:

The landscape began to change drastically in the post-COVID era. The Ukrainian conflict and subsequent Western sanctions against Russia shifted geopolitical and economic dynamics, leading to a realignment in trade patterns, particularly between Russia and China. This realignment has impacted rail freight capacity, with a substantial portion of rail resources being redirected towards routes favoring Sino-Russian trade. Consequently, only a limited share of rail capacity is available for Europe-bound freight, presenting a significant constraint for forwarders and shippers.

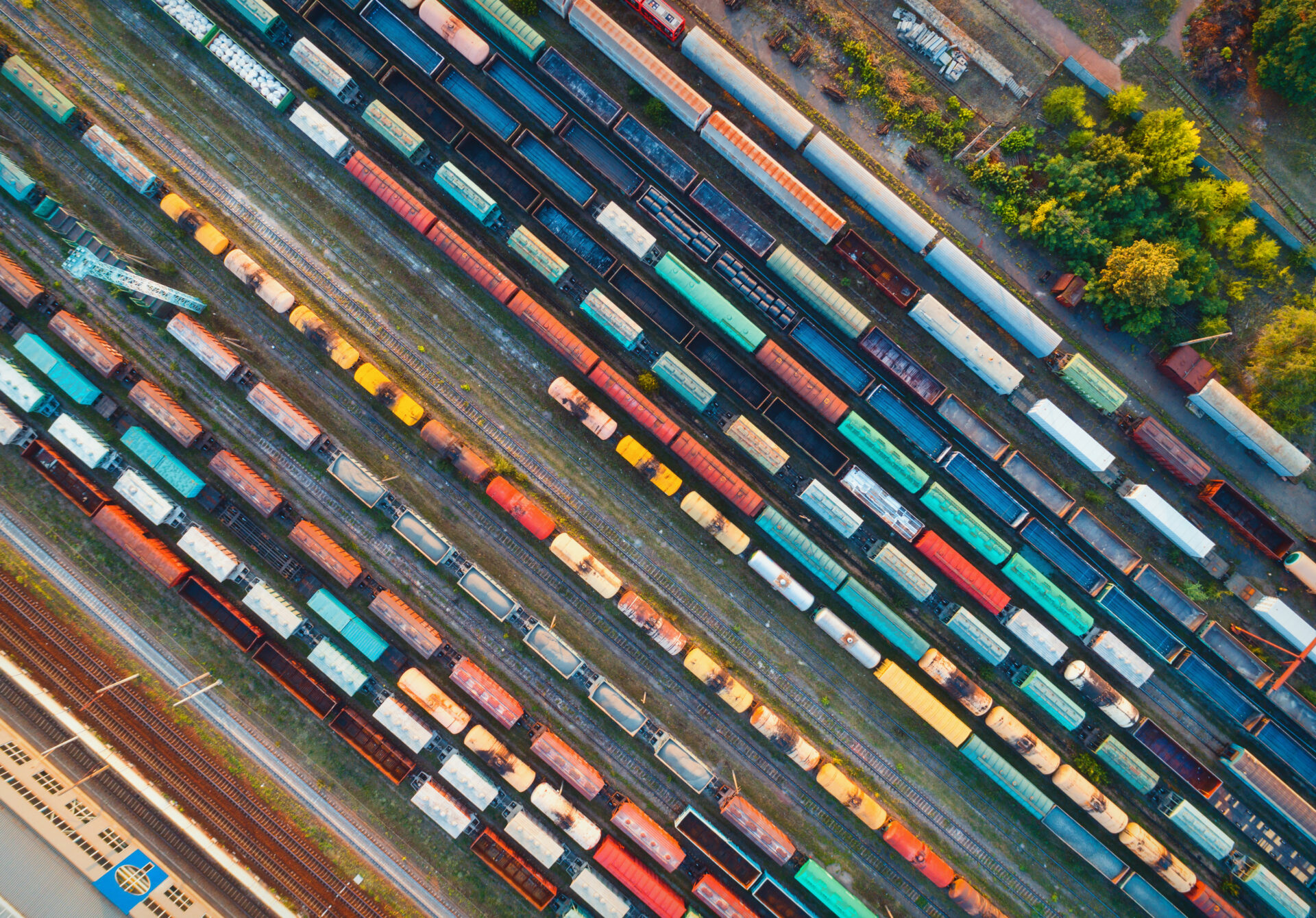

Rail Freight Capacity Constraints:

A key aspect to understand in the current scenario is the inherent capacity limitations of rail freight when compared with sea freight. A typical freight train can carry around 100 TEU, which is considerably less than the capacity of a cargo ship. This limitation, along with the impact of two years of conflict in Ukraine, has overstretched the rail infrastructure’s capacity to handle sudden spikes in freight volume.

While rail freight offers stability and economic benefits, its structure and market dynamics make it less suited for immediate crisis response. In the context of today’s shipping crisis, rail freight offers an alternative mode for smaller-volume FCL and LCL shipments and a reliable option for shipments planned in early 2024 that may otherwise see themselves delayed by the long-term effects of current maritime disruptions.

Forto’s Rail Freight Service:

Forto offers robust rail services covering most routes to major European Points of Delivery (PODs). Our control at both ends—in China, Poland, and Germany—allows us to ensure the care of every shipment from door to door. Our services include both FCL and LCL options, with a transit time of 12 days from China to Duisburg and Hamburg via express services and an average of 18 to 20 days via regular speed trains.

Managing Shipments in the Red Sea Crisis

In the face of the Red Sea shipping crisis, where swift and flexible solutions are essential, Forto recommends exploring sea/air multimodal options. These services combine the economic benefits of sea freight with the expediency of air freight, providing an agile and effective solution in urgent situations. Looking ahead, rail freight emerges as an excellent, stable service, offering a reliable and cost-efficient means to transport regular cargo volumes.

For detailed information on how Forto can assist with your rail freight and sea/air transport needs, please feel free to reach out to us.