-

Growing interest in rail as a viable alternate mode of cargo transportation from Asia to Europe

-

More freight forwarders are offering Asia to Europe rail solutions

-

Could a shift in market share from ocean to rail occur?

The One Belt, One Road Initiative, also known as the Silk Road initiative, was officially launched by the Chinese government in 2013. The economic plan is designed to link China with Central and South Asia, the Middle East and Europe by road as well as by sea.

So far, the financial investments in the project is in the hundreds of billions of dollars as Chinese investments in such road projects in Kyrgyzstan, Tajikistan and Kazakhstan make way for an alternative mode of transport as well as provide potential economic gains for countries such as these three.

The magnitude of this initiative is hard to imagine until one witnesses the train roll into London after traveling 18 days from China, loaded with items such as laptops, smartphones, apparel and food items. Indeed, London is among the latest European connections within the plan.

Currently, there are 39 lines that connect twelve European cities with sixteen Chinese cities and plans for an additional twenty European routes are already in the works.

Rail, a Real Option?

While overall statistics are difficult to come by, Chengdu, the capital of China’s Sichuan Province, notes that 460 cargo trains to Poland, the Netherlands and Germany ran from its location in 2016, more than any other Chinese city. In total, Chengdu’s trains delivered a total of 73,000 tons of goods worth $1.56 billion. This year, the city plans to run almost 1,000 cargo trains to Europe.

While overall statistics are difficult to come by, Chengdu, the capital of China’s Sichuan Province, notes that 460 cargo trains to Poland, the Netherlands and Germany ran from its location in 2016, more than any other Chinese city. In total, Chengdu’s trains delivered a total of 73,000 tons of goods worth $1.56 billion. This year, the city plans to run almost 1,000 cargo trains to Europe.

As capacity issues in ocean and air freight markets weigh on freight forwarders’ profitability, solutions are being developed to address China-Europe rail as an alternative solution. DB Schenker, DHL, DSV, FreightHub, Kuehne + Nagel and Panalpina are among a growing number of forwarders to offer such forwarding solutions. Many of these solutions are multi-modal and include full container and less than container load cargo on the rail followed by truck or other mode for final mile delivery in Europe.

Rising Interest in Rail

For the most part the Asia-Europe rail service has been treated with skepticism among shippers; however with the collapse of ocean carrier Hanjin, the uncertainty around the new alliances and the growing expansion of the rail network, shippers are looking at this modal option in a new light.

According to a recent Journal of Commerce article, forwarders are reporting increasing demands from shippers to include the China-Europe rail option in their portfolio of services.

The article notes that “Hanjin’s 2016 failure gave shippers a major scare and had them seriously looking for alternatives to ocean transport and the severe capacity constraints out of Europe as carriers reposition ships for the new alliances has had the effect of accelerating the shift of China-Europe rail into mainstream shipper consciousness”.

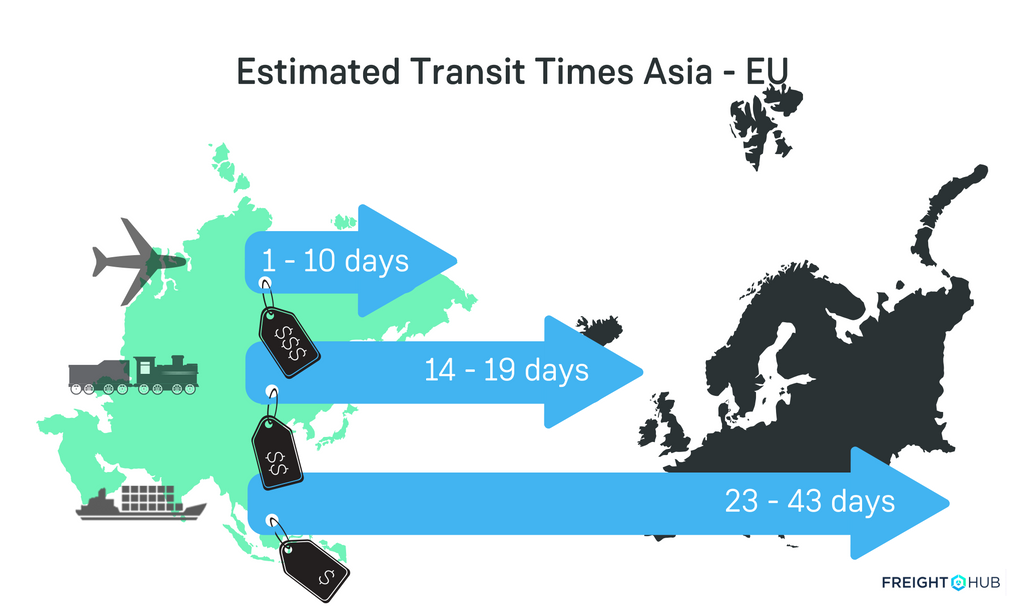

As a result of this interest in China-Europe rail, could market share possibly shift away from ocean and air and favor rail? Some industry analysts believe so given the fact that it takes less time to travel by rail versus ocean in particular.

Pricing of rail transport is reportedly less than air but more than ocean and despite the advantage in average travel days, security could be a concern as freight must swap trains along the way, as railway gauges vary between the connecting countries.

What Mode of Transport is best?

So what mode is best for what type of shipments? As always, it depends on such requirements as timing, special handling, costs and more. It’s usually best to work with a freight forwarder to compare the alternatives.

In fact, chose a forwarder that can provide a transparent view of all costs and complete end-to-end visibility and tracking from pickup to final delivery. Chances are there are limited number of forwarders, if any, that are able to provide such a detailed level of visibility for Asia-Europe rail. FreightHub, the digital freight forwarder, can provide this level of service. Check us out on our website, follow us on Twitter and let’s connect on LinkedIn.