The Red Sea Crisis and the Ever Given Incident may appear similar, but the differences in their context caution us against hasty comparisons.

In early 2021, the Suez Canal faced a disruption when the massive +20,000 TEU container ship, Ever Given, got stuck, causing a global trade blockade for almost a week, with effects that lasted for months. Fast forward to 2024, and the Red Sea shipping crisis presents its own set of challenges. While there are similarities, the underlying dynamics and impacts on global trade distinguish these events. This article explores these differences, with a focus on current and emerging trends.

Differences in demand and supply between 2021 and 2024

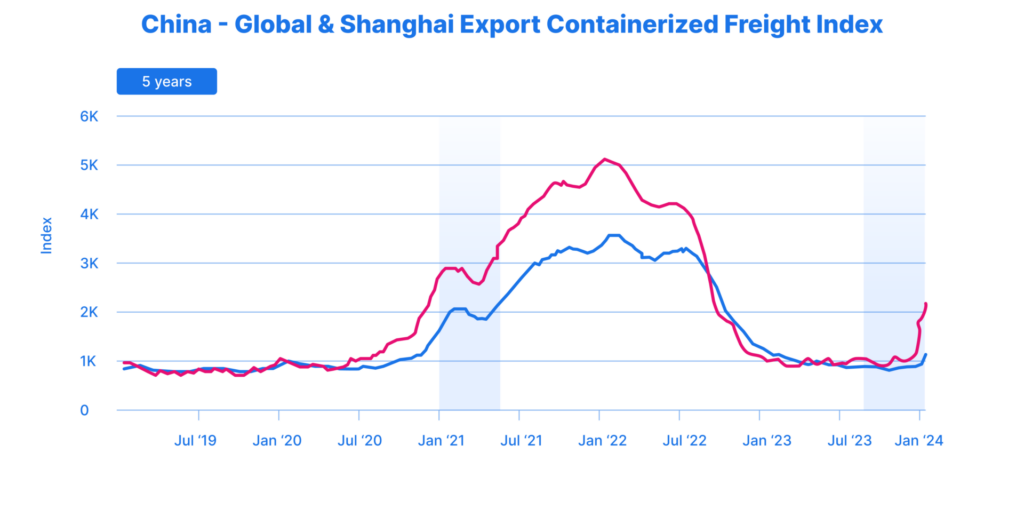

The Ever Given incident happened during a unique demand-supply scenario, evident in the Shanghai Containerized Freight Index (SCFI). During the Suez crisis, the SCFI was ~1.9k USD, representing a ~110% increase from the previous year, although considerably lower than the peak at the end of 2021. In contrast, the first rerouting during the current Red Sea crisis occurred with the SCFI below 900 USD, less than half the value of March 2021.

Although rates have been increasing since the incident and capacity constraints are expected in the coming weeks, the 2024 market experiences less pressure than that of 2021 as more capacity enters the market and limited demand growth is projected for the year.

Low Global and European Demand Growth

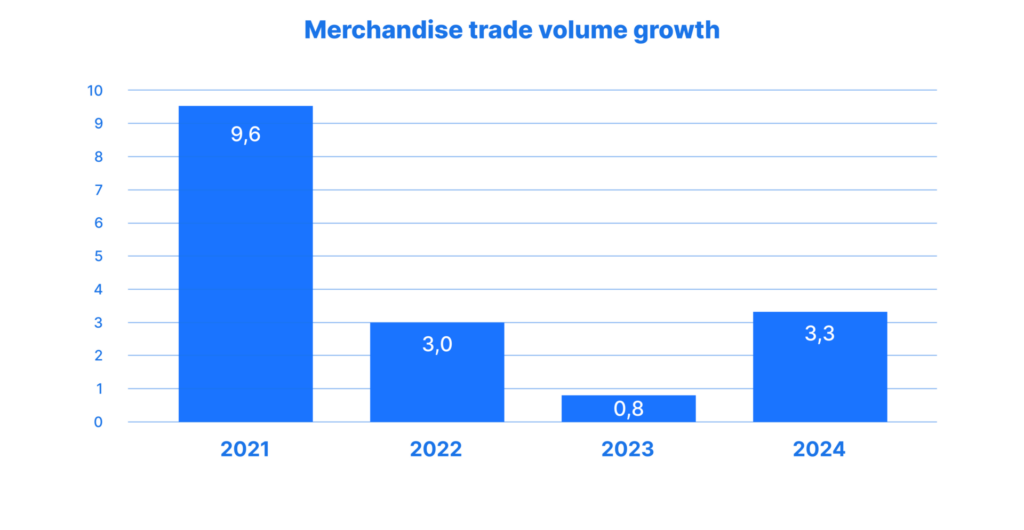

The Ever Given incident took place during a year of significant goods demand amidst pandemic restrictions. The World Trade Organization (WTO) estimates global trade growth in 2021 at over 9%. In contrast, we now transition from 2023 with virtually no growth to 2024 with an estimated growth of 3.3% (WTO)

The European economy, in particular, finds itself in a delicate state. European demand reflects cautious consumer spending, where nominal wage growth lagging behind inflation is causing a stagnation in retail sales. While progress has been made to curb inflation, economic growth projections remain moderate at best, with an expected growth of GDP of 1.3%.(European commission)

This striking difference in demand between 2021 and 2024 provides us with an important lens to look at these two Suez disruptions in terms of the impact that this is going to generate for importers and shipping lines. But there is one more factor to consider: the capacity available on the seas.

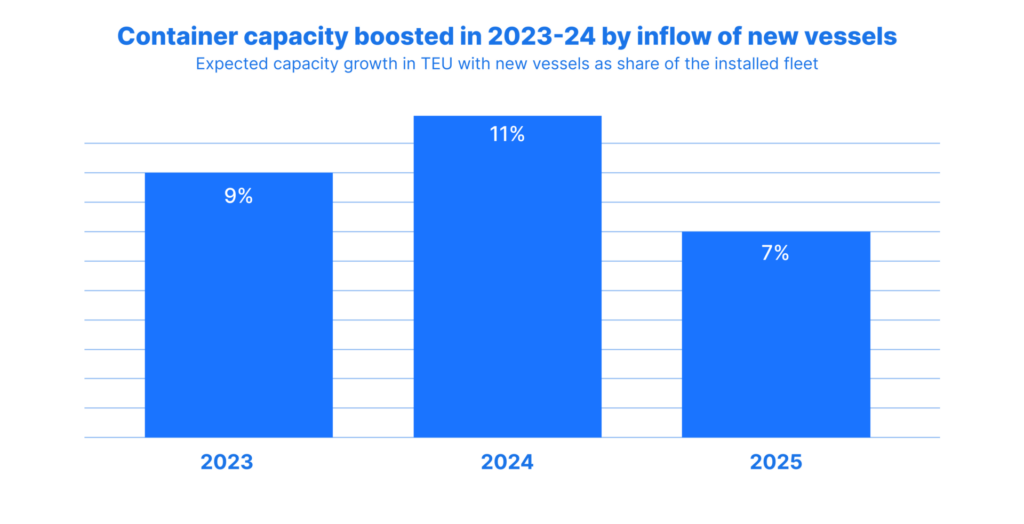

Influx of New Capacity in the Market

Sea freight capacity, measured in TEU, increased by 9% in 2023 and is expected to continue growing in 2024 and 2025, with approximately 27% of the global fleet expected to be new between 2023 and 2025 (ING research). This implies that these constraints may be short-lived, particularly if a new trade route normalcy and equipment/capacity distribution settle in, despite ongoing restrictions in the Red Sea.

Reduced Frequency of Disruptions

The Ever Given incident stood out as an extraordinary event for global supply chains, occurring during a period of numerous incidents: origin ports closed for weeks, supplier factories shutting down, and congested destinations in Europe and the US. At the same time, there was a demand and supply shock that reverberated across supply chains and impacted consumers’ wallets. Currently, while we live in an increasingly complex geopolitical landscape that could create more shocks in the future, ample capacity and low demand allow for the Red Sea traffic interruptions to be more easily absorbed.

From 6 Days to Several Weeks

While it is reassuring that this crisis occurred at a time when the market can more readily absorb the shock compared to 2021, the duration of the delay differs significantly. The Ever Given was blocked for 6 days, whereas we are currently several weeks into a blockage that is projected to continue for a few more weeks at least. Adding an additional 10–14 days of transit time requires significant replanning for shipping lines, including both vessels and containers. In particular, the two-week extension of transit time for empty containers to return from Europe to Asia presents a substantial constraint.

Conclusion: A Distinct Crisis with Valuable Insights

The Red Sea shipping crisis differs from being a mere replay of the Suez Canal incident. The current situation is influenced by excess capacity and reduced demand, which helps mitigate the impact of the disruption. However, it also leads to a longer and more uncertain recovery. Although post-COVID global supply chains have proven to be more resilient to shocks, there is a limit. If additional disruptions follow, the compounding impact will escalate.

Ultimately, the lessons learned from the Ever Given Suez Canal incident, which can be applied to this situation, highlight the importance of striving for more resilient, flexible, and transparent supply chains. As this crisis evolves, these principles continue to be indispensable in navigating the persistent uncertainties of the global trade environment.