-

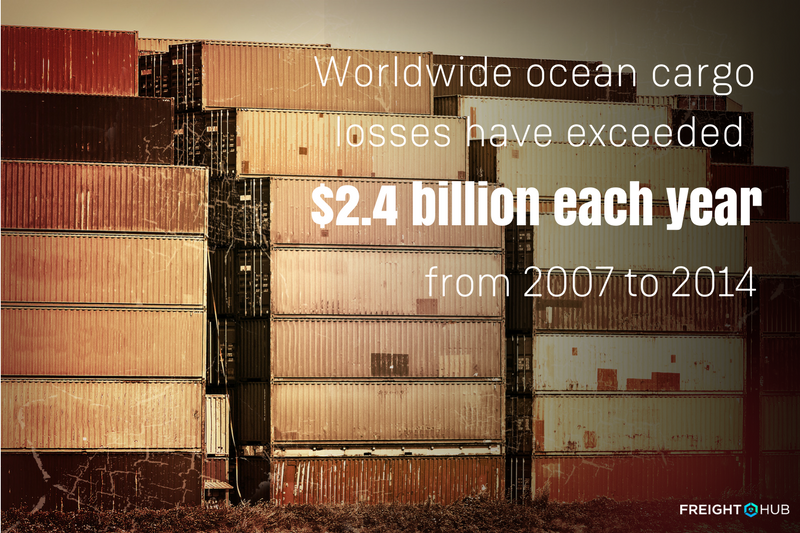

Cargo losses exceeded $2.4 billion each year from 2007 to 2014

-

Container accumulations are leading to more industry claims

-

Shippers need to understand how marine insurance fits into their risk mitigation

Ever been notified of a damaged container? How about a lost container? If not, consider yourself lucky; however, the chances are good that you will experience one or the other at some point. According to the International Union of Marine Insurance, annual worldwide ocean cargo losses have exceeded $2.4 billion each year from 2007 to 2014. Mishandling of cargo loading or unloading, weather conditions and piracy are among the growing reasons for damage.

Container accumulations on the increase

Industry trends are pointing towards an increase in container accumulations, which in turn, according to insurance companies, is leading to more insurance claims. Ships are getting larger. Storage facilities are getting bigger and more containers are being moved and kept in fewer places. Shippers may be saving money by taking advantage of cargo accumulations but a damaged ship, fire or a delayed shipment could mean the loss of a significant amount of cargo.

Consider the Tianjin explosion in 2015 in which a series of explosions at a container storage station at the Port of Tianjin killed 173 people and injured hundreds of others. Claims related to the Tianjin disaster could make it the largest marine insurance loss in history at a total of up to $6 billion, including claims for up to 70,000 vehicles.

Rising number of claims

Unfortunately, there are increasing examples of such disasters at sea and ports, and thus, the maritime insurance industry continues to adapt to the growing array of claims:

- On May 2017, containers on the VLCC MSC Daniela caught fire en route from Singapore to the Suez Canal, as firefighting was hampered by thick, toxic smoke and distress signals went out to local authorities.

- In Port Elizabeth, South Africa, the Transnet National Ports Authority battled a blaze aboard a cargo ship anchored in Algoa Bay, as they evacuated a 21-person crew.

- The El Faro sank in October 2016 during a Category 4 storm, embroiling owner TOTE in multiple lawsuits from crew members’ families.

- Somali pirates hijacked and gained control of the German ship Taipan in 2010 for a short time before Dutch forces raided the ship and arrested them.

- Estimated marine losses from the 2015 Tianjin explosion were more than $6 billion, and 2012 Superstorm Sandy caused $3 billion marine loss (including $2 billion cargo loss).

Marine insurance and risk mitigation

As a shipper, if you’re adapting your cargo insurance policy to ensure the best coverage, it’s important

- to understand how marine insurance fits into your risk mitigation

- whereby gain a complete understanding of

- how your freight moves through areas that put it at more risk from catastrophic loss,

- how these areas contribute to overall portfolio loss, and

- how packaging and salvage potential factor into your analysis and choice of policies and coverage.

Moreover,

- fully understand your cargo type, precise storage locations/types, and dwell times to determine port exposure and accumulations.

- understand how IT systems can increase your exposure to cyber risk. As RMS reports, “There has already been one known incidence of Somali pirates having infiltrated a shipping company’s systems to identify vessels passing through the Gulf of Aden with valuable cargoes and minimal onboard security, leading to the hijacking of a vessel.”

- consider that most ports do not yet have the infrastructure, terminal space, dock equipment or rail connections to handle mega ships, which concentrates cargo risk by putting more cargo on bigger ships with a greater possibility of catastrophic loss from an accident in port or at sea.

In fact, it’s worth noting that the onboarding of dozens of mega ships over the next few years will likely begin to tilt the balance of cargo insurance costs and premiums. As an article in splash247.com recently noted, with larger mega containerships in the mix, the prospects of problems of greater magnitude and seriousness increases [as do greater costs of casualties] … show[ing] just how expensive maritime accidents are becoming, while introducing both operational and legal challenges that we have yet to see.

Easing the assessment and understanding woes

Shippers and Carriers alike should assess not only the amount of insurance coverage they have but know what their policies cover versus not cover; however, this assessment can be a daunting task. At FreightHub we partner with a leading insurance provider to ease this task and thus allow shippers to focus on their expertise while we strive for a safe and timely delivery of shippers’ goods. To find out more, visit our website and watch this 99sec product video below: